I never thought we would say Adios to our Texas residency, but doing so is the only option to get better health care for nomads like us. On Friday we leave FOY, and by this time next week, we’ll embark on our Colorado duplex experiment.

Crazy moves for better health insurance isn’t so unusual

As I mentioned in my Full-time RVers Health Care Options post, coast-to-coast health insurance coverage is non-existent today. The gory details are in that post so be sure to check it out if you haven’t. When I wrote it, I wasn’t sure what our next move would be. Only that we needed better health insurance.

Meanwhile, Jim discovered the Colorado duplex for sale. Around that time I told our accountant that we were thinking of buying the property and becoming Coloradoans so we could have better health coverage. She wasn’t surprised. “I’ve seen my clients do crazy things to get better insurance,” she said. Relocating to a state with better health care for nomads didn’t surprise her one bit.

Better health care for nomads is why we will domicile in Colorado

In doing my research, I discovered that Colorado ranks relatively high in the list of best states for health care options. The state manages its own health insurance plan marketplace and it must be doing something right. When I went to the Connect for Health Colorado website to check out plan options, it returned about four different health insurance companies and 35 different plan choices for us. It was eye opening. As Texas residents, Blue Cross Blue Shield was the only game in town. And it never covered us outside of Texas.

But just because we had more choices in Colorado, and a generous Affordable Care Act subsidy, most plans were still too expensive for us. Still, I managed to find at least four affordable options, and the winner was a Kaiser Permanente health care plan.

Why Kaiser makes sense for West Coast nomads

- Kaiser manages its own health care facilities in our favorite places to roam: Colorado, Washington, Oregon, and California.

- We can receive any type of care at any of Kaiser’s facilities in any state where they practice, whether it’s an emergency or not.

- All Kaiser plans have telemedicine visits with primary care docs and specialists too. And the best part: Kaiser telemedicine visits are free and unlimited wherever we happen to be.

- Vision care and eyeglasses are included in our coverage (but subject to the deductible).

Like any provider, Kaiser isn’t perfect. Our plan has a stupid high $8k per person deductible, and as an HMO entity, we are limited to getting care within their network. We will still keep our MASA air ambulance plan, but ditch our telemedicine plan.

Sure, it’s not all rainbows. But based on a good friend’s experience, and the care my parents have received at Kaiser (I’ve taken them to appointments many times), the shortcomings are worth the switch. Each time I’ve interacted with Kaiser, I get the impression that their employees from the bottom up actually like their jobs. Their professionalism far exceeded almost all of the private practice providers I’ve dealt with through Blue Cross. Now we’ll get to see if my impressions match reality.

Yes, we will still travel

Like I said, the Colorado property is an experiment, just like Jerry’s Acres was. We may love living there and never want to leave. But I doubt it. Our wanderlust is too strong. For now, we’ll ride out the pandemic and spend summer in Fort Collins, then fly south for winter. Of course I’m not thrilled about having mortgage debt, or paying state income tax again. Texas was a cheap state for domiciling in. But it all comes back to the truth: you get what you pay for. I’ve never been happier to ditch our Texas domicile to get better health insurance for nomads like us.

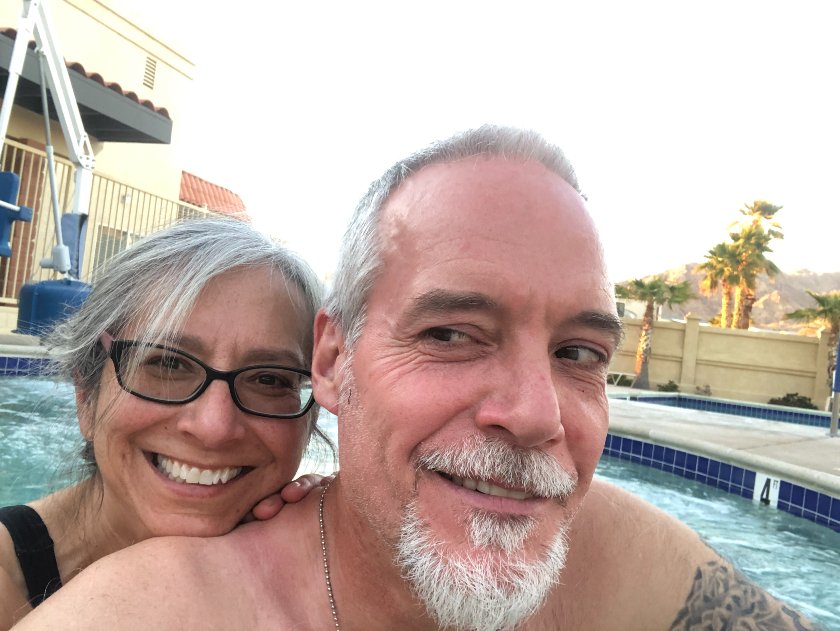

Just found your post searching for medical care advice for full-timers. We’ve been FT since Sept 2019. My husband retired early out of The Woodlands, TX & we thought “Great! Escapees is close, easy domicile decision. We can keep our doctors & come back 2x/year (for dh’s diabetes) to see our current doctors. And we are able to keep his insurance until he’s 65, so we have a while to figure out what we will do for my insurance in 6 years, since I’m only 53. After hunkering down in SE Texas for 4 months last year due to COVID, we started questioning that decision. Then I had a scare in Flagstaff that led to an ER visit. Now we’re in Houston for doctor appts & dh has a kidney stone & I need additional consults, so we’re stuck for a while. We have decided to find a new medical home & Ft Collins is on our radar. I’ll be keeping my eye on how you are doing while we try to figure out our plan. Good Luck. If your interested, we have a irregularly updated travel page on FB: MadMacsCoddiwomple

Hi Cheryl, thanks for sharing your experience. I’m so sorry that you have needed to access big time medical care recently, hope you are on the road to good health soon. Feel better and don’t worry, there will be plenty of time to explore. I’m heading over to your FB page, great name!

We’re Florida residents, but we are about to head to Canada (husband is going back to school) in an attempt to protect our health insurance for the long term.

We don’t have complete confidence that the Marketplace won’t go away under a future administration. Since we are sold on a future of self-employment, we’d like to know our government won’t take away our health insurance options. We had seriously looked at CO and OR in large part for their health insurance and functional medicine practitioners. But we’ve decided to play the long game and see if we can get Canadian citizenship – and we will do so while living in a bucket list location for us, Prince Edward Island.

5-8 years from now until we even have a sense of whether it’s working, but we were ready for our next adventure.

Fort Collins is fabulous as you know – it would have been a top contender for us too. I hope it’s a wonderful fit for you.

Jamie thanks for reading and commenting! I saw the news on your blog and am so jealous! CONGRATS! I look forward to seeing how the transition goes. You guys will rock it! Canada was always on our list for citizenship, especially because Jim’s got family ties in Ontario, though he was born here. But when we scored our citizenship potential, we came in at like ZERO chance to get in. Canada wants people in their early 30s to early 40s, with J-O-B-S. That’s definitely not us. We plan on spending summers there when we get bored with Fort Collins, but otherwise we’re stuck being Americans. So we will live vicariously through you and Ross! Have fun on PEI!!!

Glad we got to say hi as you were packing up, afe travels! We were on Kaiser for 30+ years when I quit working to start my own business. We now have Liberty Healthshare a Mennonite organization, not perfect but affordable. It’s worth a look if you haven’t already.

Thanks George! Maybe next time we can hang out. Glad that Kaiser worked out for you. Haven’t heard of Liberty before, that’s a new one. Keep in touch and good luck with the business!

Colorado duplex, interesting, didn’t see that coming. Make sense though, as does the write off. We missed you at FOY last week as we passed thru..

See ya next time..

Dude what a bummer! So sorry we missed you. We will definitely meet up next season!!!

$8K out of pocket—eek! That’s even worse than when I had private insurance through the California exchange (and no subsidy). It’s so crazy how much insurance costs have skyrocketed over the years.

So in very rare instances, if you need a specialist that Kaiser doesn’t have, they will on occasion refer you out. We used to see Kaiser patients at UCSF in the pulmonary sub-specialty because Kaiser didn’t have the expertise in the rare conditions we treated. It doesn’t happen often, and I’ve heard you really have to push for it and have a serious condition that requires treatment (like if you’d die without proper care).

Since you’re taking this plunge, I thought you should know about this in case such an issue comes up. I hope it never does, though.

Yeah Maya isn’t that outrageous? I was stunned that even Kaiser–on or off the exchange–has mostly high deductible plans now, ranging from $2k to $13k pp/yr! The only one without a deductible was $700/month WITH our subsidy! My mom has this plan because of my dad’s union pension, thankfully. Those days are gone for the rest of us. Sigh. THANK YOU for letting me know about accessing a specialist. I hope we never have to do that, but it’s good to know the option is there if we advocate strongly enough. I know who I’ll be calling if we need to go that route 😉

I love Kaiser! Of course I’m still working full time and it is my health plan through my employer. I had my 1st knee replaced in December and a PT came to my home the day after surgery and once a week for a month. I paid nothing out of pocket! We are want to buy a home base when we retire in a year and half but we aren’t sure where. We rent now and the market here in California Sierra foothills is ridiculous!

Hey Terri that’s good to know. My friend in Oakland wants to buy in the foothills too and says the same thing. Glad you’ve had a good experience with Kaiser. Hope your knee is feeling great!