Want to know how to pay for full-time RVing? Start here! This is part two of our three-part series about how to plan and pay for a life of full-time RVing.

Prepare for Full-time RVing Series: Part I | Part II | Part III

Download all 3 as PDF

One of the most popular questions full-time RVing dreamers ask is: how much does it cost to live on the road full-time?

Yes, you can pay for full-time RVing and enjoy the nomadic lifestyle before retirement. Unfortunately there isn’t one perfect answer. Costs for full-time RVing fluctuate wildly depending on a RVer’s personal spending habits – from eating and partying, to the type of rig, to where someone prefers to call home. While many full-time RVers cook at home every night, others prefer to eat out more often. Some enjoy exploring free roadside attractions, while others enjoy more lavish entertainment.

When considering how much it costs to live in your RV, remember; what may seem like a life of excess to one person can be a bare bones existence to another.

About the only thing that we can say for sure is that, in general, it costs us less to live in an RV than a stick house. For example, even with all of our traveling, our fuel costs are similar to those who make a long commute to the office every day. That’s because we generally don’t do a lot of driving once we settle down into an area for a few weeks, or an entire season. While on some days you’ll find us covering a few hundred miles, sometimes we won’t drive anywhere for weeks at a time.

This lifestyle also costs us less because we don’t spend money on things like gardening projects, home improvements, decorative bric-a-brac or extra sets of guest linens. In our previous life, we would make impulsive trips to Costco nearly every weekend! Our pocketbook – and our waistlines – reflected our suburban shopping habits. Today, we don’t have an outdoor freezer to stock and it’s hard to buy in bulk when you have a small RV fridge and limited storage space.

While there is an emotional price tag to full-time RVing, if you want to know what this lifestyle will cost you, here are our best tips to help you get on the road, worry-free.

Get Your Finances in Order to Pay for Full-time RVing

Do you know what your average household expenses are for food, shelter, fuel and utilities? Can you track your spending habits to the penny? If so, congratulations: you’re almost ready to hit the road! If not, rest assured you aren’t alone, most people have no idea what they actually spend each month.

If your financial picture is hazy, DO NOT turn the key just yet! Doing so will only lead to disaster and disappointment. Instead, take road trip baby steps by setting up a household budget and putting your financial house in order.

Start tracking your living expenses before you drive your first mile, or you could be in for some expensive surprises that quickly put an end to your road trip dream.

If you are a couple, work together! This is a two-person endeavor, there’s no way around it. You cannot hit the road unless each of you knows the precise state of your financial condition.

Step 1: Track Your Expenses

To create a full-time RVer budget, first you need to know how much money you make and where it all goes. The only real way to do this is to save your receipts and start entering your expenditures each month into financial budgeting apps like YNAB. The more time you have to do this before you hit the road, the better.

Once you begin tracking your monthly expenses, it will be easier to translate those numbers to a budget for living on the road. Your rent or mortgage and home maintenance costs will convert to RV Park fees and fuel while other expenses should remain relatively the same.

Do your Homework to Avoid Surprises

Discuss typical costs of traveling in different types of rigs with like-minded RVers or other full-timing families, if applicable, for a better understanding of what to expect.

Search online and you will find many RVers blogging about the cost of living on the road. Find those with a lifestyle similar to yours to help estimate your own expenses.

Step 2: Act Your Wage!

After you have tracked a few months of expenses, average them out on a month-by-month basis. Next, subtract your average expenses from your income. This figure is your bottom line.

If your expenses are greater than your current income, analyze your spending habits to see which categories can be scaled back, if not eliminated altogether, like restaurant trips, cable/satellite TV, expensive cell phone plans, magazine subscriptions and gym memberships.

These reductions are painful but in the long run you’ll get on the road faster if reduce your expenses. As you do so, start following Dave Ramsey’s Debt Snowball advice so that you can hit the road without the worry of debt.

If you’re spending more than you earn, your expenses may not be the problem. A lack of income may be the real culprit.

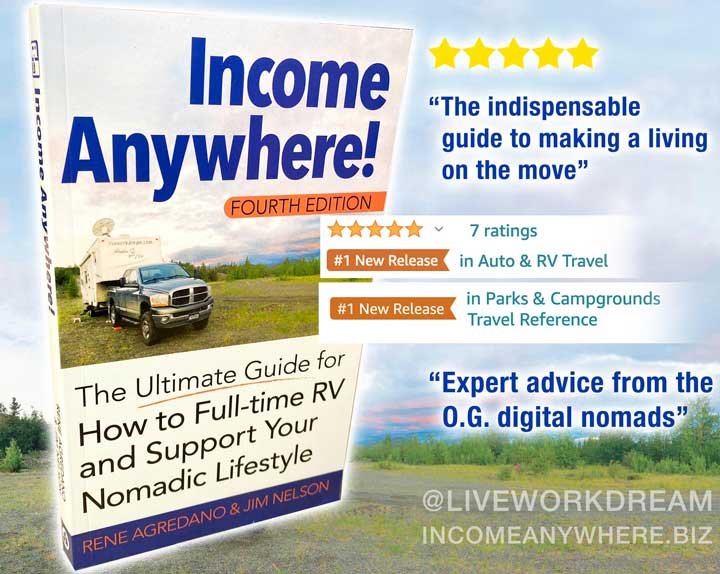

Need to boost your income? See how we do it by downloading our Income Anywhere! e-book! The book is filled tons of ideas to help you make more money and start full-time RVing faster.

Get Out Of Debt

Road tripping with debt didn’t seem like a problem to us when we embarked on our sabbatical in 2007. We owed nearly $60,000 on a brand new rig and truck that we considered our “reward†for working so hard for the past decade. At that time, we didn’t realize . . .

Debt is NOT a Reward, it’s a Trap!

We were clueless until a debt-free family introduced us to the Dave Ramsey debt-free way of life in 2008. They handed us a copy of Dave’s Total Money Makeover, and that’s when we realized what a bad idea it is to travel with the worry of debt.

Dave taught us that owning money to someone else, whether it’s a family member or an international corporation, limits your options in life. It sets your dreams back for years, since you can’t make any major life changes when you owe money because you’re forced to work in order to pay down that debt. Working to pay off debt also robs you of any free time you need to pursue risk-taking activities that can help you fulfill your dreams.

Once we realized how enslaved we were to our RV and truck loan companies, we cracked open our nest egg. We paid off the rig and felt a true sense of financial freedom for the first time in our relationship.

Take Baby Steps to Freedom

Dave Ramsey teaches seven baby steps to financial freedom. We’ll paraphrase the first three below. Start with these before you hit the road, then stay on track with the other four after your new lifestyle is well established.

Baby Step 1: Save $1,000

This is when your new budget will come into play. With the extra money you save by cutting back expenses, you can begin creating an emergency fund, which Dave recommends to be $1,000. Doing so not only gets you into savings mode, but it brings peace of mind to know that money’s there when (not if) an emergency strikes.

Baby Step 2: Start Your Debt Snowball

Hold garage sales and sell as much as possible. You’ll feel optimistic as you bring in money and downsize in preparation for your full-time journey. Put together a list of all your bills. Take care of necessities first—food, shelter, utilities, etc. Then get to work paing off your smallest debts first, one by one, while making minimum payments on larger balances. Forget about which one has the higher interest rate. You’ll feel a far greater sense of satisfaction as you modify your spending behavior by creating momentum and seeing how easy it is to quickly eliminate debt.

Baby Step 3: Save 3 to 6 Months Expenses

Dave says “save 3 to 6 months of living expenses†but we advise saving more if you plan to live a vagabondish lifestyle, which can have its own unique set of financial challenges depending on the type of RV you have. Put your savings in a money market fund.

Considering an RV mortgage? Think twice!

“The difference between a dream and a goal is a plan.” — Dave Ramsey

Stop dreaming and start making plans to reach your goal today!

In our next and final blog post in this series we’ll share how to set up a budget and where you can save money so you too can live your road trip dream.

Get many more helpful tips to pay for full-time RVing by making money on the road in our #1 New Release ranked workamping guide and full-time RVing handbook, Income Anywhere!

A really great resource for tracking expenses is mint.com – it’s free and will sort everything into categories for you, and you can customize. I’ve found it incredibly helpful.

Thanks so much for a great resource – making the shift from “dream” to “goal” for full-time RVing.

tamara

I am a music educator that’s been in the public school system for over 20 years. I am ready for a change. I am recently divorced with no small children. I recently bought an RV and want to go full time. I would use my sister’s house as a home base so I could visit family as often as possible.

Thanks Rene, I always enjoy these posts. We’re on week five of full-time. Still figuring things out….we’re a bit of a work in progress, but knew after our 4 months out on the road this past winter that we weren’t happy sitting in our sticks n bricks. So jumped in…..let the adventure begin – in more ways than one, I’m afraid 🙂

Hey Ingrid I’m so glad you’re on the road for good! Yay! Thanks so much for following along with our posts. I’ll admit I’ve fallen behind on finding out how good RVing folks like you are doing out there. This workamping job is making me crazy and I have such little time to read after work. I can’t wait till it’s over in 3 weeks, then I can finally catch up! Hope you’re doing well and enjoying summer.