We don’t own any property right now, and sometimes that worries me. So when Dave Ramsey said that wealth building with real estate is not necessarily the fastest path to financial security, I was elated.

Jerry’s Acres was a chapter in our life that we won’t soon forget. Owning rural property was always on our bucket list, and we got a huge sense of satisfaction when we bought it. Now that we don’t own that lovely spot, we miss the solitude and scenery, but almost two years after the sale, I sleep better at night without the burden of home maintenance expenses, property taxes and home owners insurance.

Still, I worry that by not owning real estate during our working years, we’re missing a key component of our retirement funds strategy. But then I listened to an episode of the Dave Ramsey podcast and felt so much better!

“Real estate is not the number one way to wealth,” says the guy who absolutely loves real estate and owns tons of it. Dave backs up his advice with data from a study his company did, a survey of just over 10,000 millionaires. Nearly 90 percent of respondents said that they did not get rich with real estate. “This idea that real estate is the way to wealth . . . is such a joke.”

He goes on to explain the shortest way to wealth is:

- Step One: Get out of debt

- Step Two: Staying out of debt

- Step Three: Paying off your personal residence

- Step Four: Building wealth through retirement savings

- Step Five: Start buying real estate with cash only.

Whew! I was so glad to hear it. Jim and I do want to own property again some day in the future, but just raw land with RV hookups. Forget the homeowner burden. We love the freedom of this lifestyle, and now I know for sure we don’t have to own a home to have financial security in retirement.

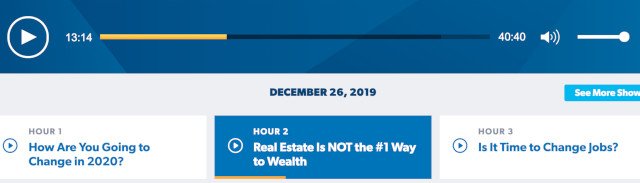

Click below to listen to the Dave Ramsey podcast where he talks about the real estate wealth building myth. It starts at 13:15.

You crazy kids, I miss you both, but let’s hold up for a moment to rub more context on this financial pork shoulder.

Buying low and selling high is the key to wealth, whether it’s through stocks or real estate

or labor, that’s what it’s gonna take to generate big moolah. With real estate you have to be

patient, smart, hardworking/tireless, and have a talent for working with all types of personalities.

With stocks you can cherry pick and simply wait, however, I advise working through a brokerage

and develop a “portfolio” but that’s a waiting game too (most things are). They say if you practice the banjo

slowly you learn faster.

But let’s step back before we put this brisket in the oven, wealth can be a goal as wealth does allow for more choices

with regards to things, travel, life-style and so on, but it is not a panacea for unhappiness. Happiness and

enjoying one’s life are typically achieved by doing work you enjoy, having good friends/family,

and not comparing yourself to others. Happiness is not really a goal but rather a result of enjoying your life by

doing things that make sense to your talents and sensibilities. Let’s baste that point with a few squirts of caution

in terms of the “Real Estate Myth”? Here we go, the wealthiest people I know – monetarily speaking – own a whole lot of it so

when they sell a building or commercial park or whatever, they do very well. However, the stress associated with

that climb is not for everyone. The same with the stock market. It goes up, it goes down, do you have the long-term

belly for that haunch or rack? Yes, make money, get wealthy, but if you aren’t having much fun owning a house then

it most certain isn’t for you, living in an RV or trailer isn’t for everyone either. Living a life however that gives you meaning and satisfaction, now that sounds wealthy. There is an old saying about social security however, “if you were social, you’re probably not very secure”. Building some level of wealth will help make life easier as you age but that’s for another day. Now go get rich or have some fun, or maybe a delicate Chardonnay? E

True Dat Mr. Auckerman! It’s wonderful to hear from you, old friend. As always, you have sage words of wisdom to share with everyone, along with a bellyache from lol’ing at your metaphors. THANKS! You crack us up as always, and we hope to see you soon.

Interesting to hear Ramsey ideas on real estate ownership. I have friends that came off the road, sold the RV and bought a house because the RV was costing them so much money in repairs. So now I am amazed at the home repair expenses they have. New hot water heater, new HVAC system, lawn mowing service (they are old). But for some reason they feel better about spending money on the house, even though the expenses are at least triple. I don’t miss my house, but I do wish I had a large workshop for projects. I do like owning my RV lot and knowing it’s there, albeit, I haven’t gotten there in a long while. 🙁

Unless things have changed there are still counties in TX and NM where you are less restricted with regards to personal RV lots, especially as you pointed out, if you are there for 6 months or less.

I’m so glad you saw this post Larry, because you and Nancy are the #1 couple who I think of when I imagine a successful retirement life without the hassles of homeownership. I hope you two can get up to that lot real soon!

As for RV lots for us to buy, yeah, we’re probably looking at the areas around Bandera for a winter spot and maybe even CORA in Colorado for summer. There are quite a few nice RV parks in CA where you can own your lot, but I do NOT wish to pay CA property taxes ever again.

Actually, CA is on the lower end on property taxes in the country in terms of rates — one of the few things that is reasonably priced in CA. The problem is that the property itself is so expensive, and the taxes are a percentage of the value.

Good point Maya. I know people in the East Coast pay waaaaay more, percentage wise. Just glad we aren’t looking at property taxes anywhere for a while.

We’d love to have land with RV hookups too, but it seems like more and more states have started making laws that you can’t live on raw land in an RV. You could probably get away with it if nobody could see you and complain, I always get nervous about getting found out!

Hey Maya. Yeah in our initial research of our favorite states like Colorado, we found that “meets and bounds” properties outside of HOAs are rare and expensive. But many HOA developments like where we owned Jerry’s Acres, will allow RVs to park seasonally. Some require a building permit to be on file, proving that you’re not going to keep the RV there permanently, but many don’t. That’s the kind of place we are thinking of buying.

Ah, I see. That’s good to know, I’ll do more research into that!

Let me know what you find out Maya!

Fascinating. Having studied Robert Kiyosaki (Rich Dad, Poor Dad), I’ve always presumed that real estate (specifically income-producing real estate) would be THE way to wealth. His theories (at least partially in line with Dave Ramsey’s, apparently) are the reason I haven’t owned a home since 2007, but rather rent — because simply owning a home earns no money. Though I still don’t have the mobile lifestyle you guys have attained, renting has given me a mobility to explore new places to live. So has switching from a 9-to-5 salaried job to being an independent contractor. Now that I can work wherever I have a web connection, I have done a couple of extended road trips, funding them the way you guys do — by still earning as you travel.

Hey Ric, thanks for reading and commenting. You know it’s funny how the Universe brings together like-minded people in unexpected ways! So I too started out reading Kiyosaki, but migrated over to Dave Ramsey and YNAB after deciding that I didn’t want the emotional or financial burden of being a landlord in order to earn more money. Kudos to you for choosing to be a renter! There is nothing wrong with it provided that we keep a good financial cushion to protect us from rent increases, etc. It’s funny how the thinking in America is that you haven’t “made it” until you buy a house, but the irony is that the BANK owns most people’s houses, not the people tied to the mortgage. Keep blazing your own trail. I too am all for the freedom of renting and being mobile. YAY!