What a hoot. Thinking about RV loans last week I called the Dave Ramsey Show on a whim, and got to chat with our favorite financial guru!

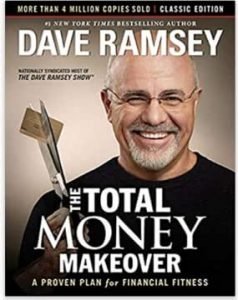

If it wasn’t for Dave Ramsey, we probably wouldn’t be on the road today. Back in 2007, a?kind soul in Florida gave us a copy of Dave’s book “Total Money Makeover,”?and suddenly, living without debt seemed possible.

If it wasn’t for Dave Ramsey, we probably wouldn’t be on the road today. Back in 2007, a?kind soul in Florida gave us a copy of Dave’s book “Total Money Makeover,”?and suddenly, living without debt seemed possible.

Total Money Makeover is a step-by-step guide toward living without debt and becoming financially secure.

Along with his show, Dave’s no-nonsense approach got under our skin enough to get us on the road to full-time RVing without the burden of debt.

We owe a lot to this outspoken critic of the American way of debt, and although we aren’t big fans of his cozy relationship with the Fox News propaganda machine, we can’t deny that he’s created a lot of positive change in this world for former credit card junkies like us.

I called his show, because I wanted Dave to resolve a current argument Jim and I have been having:

I want a larger rig, darnit!

Are RV Loans Acceptable for Full-Timers?

In the last few months I’ve had a very hard time keeping things neat in our 24′ rig.

In the last few months I’ve had a very hard time keeping things neat in our 24′ rig.

I love our Arctic Fox, but the smallness of it is getting to me now that our business needs are growing and we must fit both home and office, and an 80 pound dog, inside this tiny space.

Jim isn’t bothered by the size, he could live in it for many more years. But after much bickering, we decided that another Arctic Fox 5th wheel is best for our off-the-beaten-path travel preferences, and a 27′ trailer is a size we can both live with.

The problem of course, is how are we going to pay for our new house? This was the first time in 5 years I considered taking out a loan for something. Jim is completely opposed to it.

I desperately wanted to believe that Dave would say it’s OK to finance a new rig, since after all, it IS our primary residence. And since having an affordable, 15-year mortgage is OK by him, I figured that a 5-year, $50,000 loan on a new rig would be acceptable.

You’re On Next

So I called Dave. And here’s a brief summary of how it went:

So I called Dave. And here’s a brief summary of how it went:

Me: “Hey Dave! Thanks for having me.

Dave: Sure, what’s up?

I have what I hope is a quick question. My husband and I are self-employed, we’re debt free and we’re full-time RVers, so we live and work from our RV while traveling around the country.

Uh huh…

We run our business from our home, which is an RV. The RV is paid for

Good!

and I have been bugging my husband to upgrade our home by getting into a larger one, and now this might mean taking out a loan. And um, what are your thoughts about getting into a mortgage on an RV if it’s your primary residence?

I wouldn’t. Because they go down in value so quickly.

Really?

Yeah really they do. Don’t they?

Well, I guess that answers my question.

The problem here is this. I mean it is your deal and it is what you’re doing right now at this stage of your life. But as a long term game plan, mathematically speaking, not as a lifestyle choice but mathematically speaking, what you’re doing is basically you’ve bought a house trailer that you’re driving.

Trailers go down in value, right? Mobile homes go down in value. And so that’s what we’re doing. It’s a large car that you sleep in. You know, financially speaking, is what I’m saying.

I think what you’re doing is cool, by the way!

Thank you!

I think it’s a neat thing. If the whole family is having fun doing this at this stage of your life, probably not something you’re not going to do your whole life I suspect (but maybe you can I don’t know).

But the bottom line is, that you just don’t have money invested in something that’s going the right way. The right way is up.

So basically this is a cost of your lifestyle decision. A cost of this adventure you’re on. This adventure costs us what RVs go down, right?

Gotcha, yeah.

And that’s an OK thing. Just like if I go on vacation. It costs me X, right? And that’s an OK thing to go on vacation if you have the cash and you’re not in debt, right?

You don’t want to finance things that cost you. You don’t want to finance anything, but for sure you don’t want to finance something that’s going down.?That’s the direction.

I wish I could tell you I thought it was a good idea, but no. same thing I would tell you by the way if you were living on a houseboat. No I wouldn’t finance it. No, I wouldn’t finance the move up, and no I wouldn’t finance the move just because it’s the primary residence.

I wish I could tell you I thought it was a good idea, but no. same thing I would tell you by the way if you were living on a houseboat. No I wouldn’t finance it. No, I wouldn’t finance the move up, and no I wouldn’t finance the move just because it’s the primary residence.

Neat discussion!”

Dave Wins, We Save

Well, Dave settled our ongoing domestic battle, ’nuff said. I’m at peace with his advice since his philosophies have served us so well.

Until we’ve scrimped enough to save the extra cash we need to upgrade our current home, it looks like we’ll be on the Dave Ramsey beans and rice diet for quite some time!

?

So glad I came across this, thank you so much for sharing! Husband and I have been FT in our RV for 4 years (by choice) and are just starting our baby steps. Our ultimate goal is an upgrade and I was wondering Ramsey’s views on a minimal lifestyle and if others were in our same situation. Did you ever upgrade…are you still “happy campers” on Ramsey’s plan in an RV? Thank you again.

Yes! We followed Dave’s advice, waited, saved, and paid cash for our new (used) rig. Then we met him at the Ramsey studio, and had him sign a photo of it.

I have read Daves books and listened to his show. However, no one would ever have loans if they all had his money and we all definitely don’t, so sometimes I’m not sure Dave is living in the same world as the rest of us.

June, I don’t know if you have read Dave’s story, but he started out flat broke. He acquired the money he has through hard work and staying out of debt. He sure doesn’t live in the same world as most people, because most people aren’t willing to commit to the same principles. Those who do absolutely live in a different world, one of freedom from being slaves to lenders. Sounds like a great place to me.

Easy credit is what made America great. Ramsey is full of beans.

Cool to see you guys are Dave fans as well…but honestly this wasn’t the post I wanted to see. We had been thinking about upgrading our rig as well. Were considering financing part of it too. I kind of thought Dave wouldn’t agree with it, and now I have the proof.

Haha I know what you mean! When Dave told us his thoughts about financing a RV, it made total sense, but bummed me out as well. The good thing that came from it is that we buckled down and saved saved saved to buy our second rig and it didn’t take as long as we thought. We kept our same truck, which helped. Today I can’t imagine financing the rig we’re living in, it would have really set us back and added an extra burden. I’m so glad we didn’t. Life on the road without debt is the ultimate freedom. Debt just adds a dark cloud over the whole adventure. We avoid it at all costs.

You guys can do it debt-free too, I know it!

I’m not a Ramsey fan. I figured out the financial aspect of home budgeting long ago and live 100% debt free, including my home. Ramsey didn’t say anything enlightening in this interview, nor would his advice influence my desire to do as I see fit for my life. An RV is not an investment, but neither is most anything you buy (see your car, for starters, then look at how much a homeowner forks over for a house, such as taxes, insurance, repairs, utilities, furnishings, and see if you recoup your costs for it enough to be called an investment. Only big business and banks make money off you.) I prefer to pay cash for everything, but in situations where I need a big ticket item before I can save, I get loans with the lowest interest rates then pay it off early. Most people don’t make enough money to save for those items in a reasonable amount of time. Likewise, I wouldn’t buy new where a used item is cheaper, provided it’s in good quality shape. I get all the benefits of new with the payments of used. I only buy when it’s an item that I need, not want. I’m not pulled in by gadgets or nickle and diming myself. I think and plan ahead when it comes to my money and time.

For instance, in spite of what Ramsey says (nor would I listen to his advice putting a damper on my choices when I trust myself more than him), I actually NEED an RV because of the nature of my work. I live on the road full time and want a home, not live out of cheap motels the rest of my life (and I may never want a sticks and bricks home again). I am not opposed to getting a loan because I’m 99% certain I can pay it off early with a decent down payment. I’m looking at an RV as HOME, which I value more than money. A loan may become necessary in my situation because I need a full-time/4 season 5th wheel – I cannot fly with the birds, nor do I have the cash now. I trust only me with my decisions with my money. Ramsey can only give ideas or generalities, but in the end, you have to live with your choices and are responsible for what decisions you make and why you do it; understand the benefits or consequences in various scenarios pertinent to your life.

Totally respect your opinions Goldie. You are definitely smarter than the average bear and take a wise approach with money. For the rest of us, Ramsey provides a framework for which we can make enough money to pay cash for big ticket items.

Aloha Rene, I miss you crazy kids! I agree with both Dave and Goldie and here’s why: yes, there is no appreciation on moving vehicles (RVs, cars, golf carts, etc.) unless they are collectable or rare and desirable, case in point, certain Airstream trailers but largely that’s a fashion chase niche market like old Porsches. Taking a large loan on an appreciating asset makes the most sense when you need the interest benefit on your employment taxes (think deduction on income), or, when you’re schooled in the ways of borrowing to build wealth. Case in point, Real Estate Investment Trusts, or, taking a body of real estate assets and combining to create a dividend paying asset that goes public (this is a very complex topic, “complex topic” nice one Eric!), however, and a big however, this takes years but if you’ve got years and you know how do do this, then you can build enormous wealth. Borrowing money is all about leveraging money to make money and not to buy boats, RVs, vacations and other ephemera whose sweetness will pass once the bloom is off the rose. Most fortunes are made in real estate as the demand for land never ceases, but to get into the game you’ve got to borrow and after while you can borrow big to buy better properties, think apartment buildings or getting into property development. Bottom line and where both Dave and Goldie are correct but don’t exactly say it is as follows: there are few short cuts when it comes to satisfying one’s desires over that of one’s needs. If you need more space to grow your business then you should invest in that space, but if your business is in stasis, then live within or slightly below your means. Remember, you gave up living in a house to simplify and lower your overhead and possibly your stress levels, everything comes with a price you just have to decide if that price is worth it? Give Jimbo a big ‘ole hug for me, Eric

By the way, there are some mighty sharp people on this blog who in my opinion are asking some great questions and who have some excellent solutions to consider. For example, what is your time worth? Does happiness come before wealth building? Are happiness and wealth incompatible? What is wealth? Happiness? If we’re asking these questions then we must be doing pretty good. None of us are saying, where’s the money for tonight’s dinner? What about tomorrow’s meals? We all have drinking clean water or should have some near by? One of the keys to staying happy and engaged is staying away from the endless parade and shenanigans of celebrities and billionaires. Performing work that’s meaningful is a good start. But again, I applaud the creativity of the many folks on this blog – well done people. Eric PS: Give Jimbo a double big hug with cheese, Texas chili, and a solid dollop of red onions!

I think a good experiment would be after having bought your RV with a loan and living in it for a while, go back to the bank and ask them how much you can borrow from the built up equity in your now used RV. I bought a nice used class b and paid cash but I had been saving for years and could’ve paid for a new one but having grown up and not always getting what I wanted taught me disicipline, plus we still have a nice house to always come back to that’s also paid off. It’s really not complicated.

LOVE this suggestion, thanks for pointing out the obvious!

An RV loan isn’t all bad if you actually have a plan to pay it off later. It’s frivolous debt that is a real problem. RV’s also still hold value and aren’t gonna just depreciate instantly.

Nice article.

Thanks for reading Jim. I do think that having a plan to pay off that debt is key. The problem is that life gets in the way and even the best plans can get thrown off-track with a sudden loss of income. Then what? Agree that many RVs still hold their value though; our Arctic Fox is holding it’s own and I’m very happy about that!

Jim,

Statistically we find that an a brand new RV will depreciate 50% by the 3rd year. So really if you are going to finance an RV it would be better to get one 3 years or older and then pay it down and you will minimize loss of value.

This is really good to know and is great advice for RVers shopping around for a rig. Makes total sense. Thanks!

Hi! I enjoyed your post and all the comments. We made a move, albeit a bit too early! I should have read this post before we went to the bank. Here is our boring story. We married 15 years ago with a ready made/blended family and 2 kids still at home (mine). Don and I were renting a condo and while it was nice, we just wanted to be free to come and go without all the drama of packing the car for trips. Since he was a Master Mechanic, he had cars/RV’s come into the shop all the time (this was in Junction city, Oregon – RV capitol of the PNW at the time).

We bought our first rv (a 1978 concord) and paid for it outright. We used it for a year coming and going and then upgraded it to a 1989 Beaver Coach (with small loan after our trade-in). We then took the plunge and as a family, agreed to move into the Beaver full time. We home-schooled the kids and Don still worked as a Mechanic until the doctor told him no more – torn rotator cup. Fast forward a few years and the coach/tow car paid off, we ended up buying a stick house since the kids were getting older and needed more space. Paid the house off with a settlement (rare, I know) and have been there for 13 years. Last year, we bought a 1994 Winnebago Brave and financed it but on a short-term loan. Last week, we traded it in on a 1999 38′ Winnebago Vectra and financed it on a 5 year loan. THEN I read your article! I think we will be okay though. Other than the RV (new one) and a truck payment, we are debt free. The house is collateral for our RV and our investment for when we get older and can’t live a nomadic lifestyle anymore. Our income is set (due to 100% disability (VA) and SSDI). Now don’t get me wrong, I understand that this income could go at any time so we have been socking away our spare change in fear this will happen in our lifetime. The kids are raised and on their own. Well, one is in college in Africa (Missions major) but they pay their own way. So, now I am wondering if we should go ahead and try to double up our payments on this new rig, rent out the house for a return on maintenance costs for the house, and live really frugal in our fancy RV until we have this 36K paid down.

I agree with the above comments on buying used but gently used. Having lived around RV dealerships, manufactures, etc. all my life, it is amazing the difference in cost between a brand new one and one just 2 years old. Not to mention WHERE you buy your rig. The same model/year/floorplan back in JC on the Guarantee used lot was nearly 46k and here in little ol’ Oklahoma, it was quite a bit less.

Just my two cents and am willing to learn 🙂 Good luck on your big decision!

Wow oregonduckfan, you’ve got a great story there! I don’t think it’s boring at all, thanks for sharing it. Your RV sounds awesome, congrats! I would say definitely work toward paying off that rig sooner rather than later. It’s great you have a paid-off house too, congrats! I think you should investigate the feasibility of renting your place. Talk to a property management firm; if you can get a good ROI and managing the rental won’t be a hassle, why not? That’s a great asset to have on hand, especially where you live and with your financial situation.

When Jim and I started RVing we also had payments on the truck and RV, we just didn’t know any better. Once we paid it off it was a huge relief. I know you’ll feel the same way once yours is paid for too! Also, listen to Dave Ramsey’s show, it will really motivate you during the process. I know it does for us, it helps keep us grounded and debt free.

Do you have a blog? I’d love to follow along! Thanks for reading ours.

Hi! I do! I just started it a few weeks ago – well, I have two but one is recipes and stuff while the other is our journey back to the open road.

I will try to catch Dave’s show. I do know that he came to SNU (Southern Nazarene University) last fall and my son, who was on campus at the time, thoroughly enjoyed the “free” seminar. He put into practice the methods for saving his money and getting his bills paid off (what bills you have at 20 years old). lol But was able to pay for his first trip to Africa before his peers and was able to pay off his car and start saving for the trip he will take after his current one. Nick is doing a semester and 1/4 abroad so his VA school scholarships are paying for his trip abroad.

Anyway, I really didn’t think much about the loan. I just figured this was how it was done by the RVer’s that don’t have a pile of money socked away for a new/used coach.

I will look into the Prop. Mgmt. idea and see what our options are. Matter of fact, that is my next blog subject! 🙂

Here is the link – http://weloverving.blogspot.com/

Hey I’m with you, I never thought much about borrowing money either. I’m so glad I was introduced to Dave Ramsey, our life and relationship with money is completely different now because of him. Please do catch his show. Your son is so lucky he got a chance to see him at that age. Boy if I had seen Dave when I was 20 my retirement account wouldn’t be so embarassing! I can’t wait to read your blog, thanks for the URL.

Well, I thought I would give a different take on debt from the other side of the balance sheet. Our business model exists because of RV’ers and RV dealerships who took on debt and got in trouble.

Every one of our listings comes from somebody who did not think about the downside of going into debt to buy an RV, it is an uncertain economy and debt creates risk.

It is great for our customers but that is a different story!

I get where you and all of your readers are coming from on a zero debt policy, it’s a good one for sure. But here’s one last thought and consideration, if your RV is also your work-space, then there must be a tax benefit to having a loan?

When we retire (soon, very soon) we’ll sell everything as we won’t need the deductibles, but when you’re working it’s always nice to have the right offs. We keep a mortgage on our house for that very reason because if we paid off our house our taxes would be through the roof. Yes, the U.S. tax system favors those in debt to some degree (not 100%), but for the self-employed, right-offs on homes and maybe RVs are essential assuming it can be treated like a home, I’m think of fees, fuel, upgrades, interest on the loan and so on.

Do these same tax benefits port to those who live in RVs? If not, then a loan would only be convenient rather than desireable so I get the anti-loan thing too.

Enrico!

We are allowed to take the same home-based business deductions that a stick-house dweller can as far as business-related expenses for computers, cell phones, etc., but as far as taking deductions from the loan, I’m pretty sure that the IRS wouldn’t buy it, since RVs are considered recreational vehicles. But I may be wrong. It could also be a big fat red flag too.

When it comes to keeping a house for the tax deductions this Dave Ramsey post explains why it’s usually a bad idea.

Actually, if the RV is your primary residence, you can take a tax deduction for the interest on a loan in which it is secured. However, most of us won’t pay enough in interest to qualify to itemize, unless we’re buying really uber expensive RVs or have other itemizations already. And it’s certainly not reason enough to get a loan – over extending yourself just to get a tax break is hardly ever worthwhile.

Personally, I’d rather pay taxes on my earned income that has some chance of going to the greater good, than excluding interest paid to a bank, that has almost zero chance of going to a greater good.

For business purposes, you can write off a section of your RV expenses IF you have a dedicated office space.. just like having a home office. It’s calculated as portion of the square footage dedicated to office space, versus all of the qualifying expense (campground fees, mileage, utilities, maintenance, etc.). Personally, we don’t – it’s just too much effort to document versus the tiny benefit it would net us.

I agree with Phillip Harter you two because because loan rates have never been lower so why not leverage a lender’s money over that of your cash reserves as you may need said ducats for immediate or essential expenses, I’m thinking wine and possibly beef jerky, or would that be soy jerky Rene?

I would also suggest buying “previously loved” over that old or too used. The big depreciation losses are in the first three years of ownership, so why buy an older rig that needs lots of work? Doesn’t this raise the purchase price even if you do the labor? What’s your time worth is what I’m wondering? If you’ve got the time then no sweat save for sweat equity. I always think in terms of pricing sweet spots, but if you’re keen on a particular model or year then all that thinking goes out the window.

The notion that loans are a bad thing is narrow thinking given that interest rates are currently low, low, low. Besides, if you don’t like borrowing after a while, then pay off Mr. Rig if you’ve got the cash. In my opinion it’s always good to have some liquidity both in the bank and in a martini glass.

I would however agree credit cards are anathema but hey, aren’t they just for short term loans?

Enrico strikes but with other people’s money…

Interest rates are low, which is why I was tempted to take out a loan, but in the end, there is nothing like the freedom of knowing you can work as little or as much as you want, because you aren’t slave to a lender. Sure it’s an ideal scenario to pay off the loan eventually IF you have the cash. So many things can happen that can drain your reserves, it’s a real gamble to think that way.

Back when interest rates were low after 9/11, we did leverage our money, and I still didn’t sleep well knowing that we owed banks. I hated that feeling.

But I do think having liquidity in a martini glass is a swell idea! 😉

I know this is old but just came across it today. Wife and I are debt free but we live in an apt. We are saving up a 20% downpayment on a new RV we like. probably take us 3 years to pay off. I just don’t see it being as bad as paying rent. which we have to pay now regardless of where we live. I understand it loses value. I wonder if he would say anything different in that respect. Since you guys live debt free in an “own’ed” RV and we are renting atm.

Thoughts?

when I said “new” mean’t to say slightly used up to 4 years old. I just don’t want something to old.

My post isn’t old Dave, unless you consider a post from Monday old news. Thanks for reading it though. Well, I really do think Dave would say the same thing about your situation, because the RV is still a depreciating asset. Will you be full-timing or just living in one place in the RV?

I’m all for following “horrible” advice if it means I won’t be making payments on something for more than it’s worth in a few years! No, our home is not an investment, but it is just common sense to not continue making payments on a depreciating asset.

Like Dave said, this is a cost of lifestyle decision. And with it, we can enjoy our lifestyle to the fullest in our current rig as we save to pay cash for an upgrade we can afford to drive off knowing we don’t owe anyone for it except ourselves!

Regardless of the source and his bent, Dave also says, “The borrower is slave to the lender.” And my days of slaving away for someone else are done.

Being debt free is indeed awesome, and we are as well. Paying cash for your rig is a form of freedom, for sure.

However, regardless of if you pay cash for your rig or finance part of it to get it sooner – it’s still going to likely go down in value. And for sure, if you can find a suitable slightly used one, you’ll have less value to drop with that purchase. And you can insulate yourself further by not financing beyond what the expected depreciated resale value might be in 5 years? Dave’s got some great wisdom and insight – but in the end, it’s YOUR life and YOUR home.

If the space issue is starting to add any level of stress to your life, it could really be worth it to find a way to very consciously finance an upgrade as an investment in your happiness, sanity and sustainability of your lifestyle. Your RV *IS* your home, regardless if it has wheels. And I dunno, real estate hasn’t really been the investment for a lot of folks as that’s cracked up to be… so I personally don’t place it in a special category.

As you know, last year we went substantially larger than our former trailer, and we went substantially older after owning two brand new RVs. And we couldn’t be happier, and so glad we made the move. Having the space really was just what we needed to better suit our lifestyle – especially as our workload started picking up and we needed more comfortable office space.

I can share with you some of the advantages we’ve discovered with having a used RV:

– Customizations & modifications are a lot easier to justify, because we’re not afraid of re-doing something that we just paid full dollar for.

– While it’s true that you are at the mercy of whoever had it last, you also may have an advantage that the previous owner already dealt with the issues. After having owned 2 brand new RVs and 1 used – we can say, they ALL had issues to be dealt with.

Anyway, just some thoughts to add.

Whatever you decide is right for you… wishing you much success in finding and affording your next ideal home on wheels!

Cherie, thanks for sharing your experience here about your big upgrade. I found your insight about customizing and modifying the rig especially helpful. I’ve always wanted to gut the inside of our rig and redecorate in our own style but was too afraid of losing resale value because it was new.

One thing about our current model and why we are leaning toward a new one is, knock wood but we’ve never had any issues directly related to the RV manufacturing itself. The few issues we’ve had have been because of issues with the accessories (fridge, stove, auto leveling jacks). So we’ve been pretty darn lucky I guess, which makes us leery about buying used.

However, after the great feedback by all of you about your used RV experiences, we are thinking now we could go about 2 years old with the same mfr and still be happy.

Thanks so much for sharing!

And remember… on a slightly used unit, you can still buy an extended warranty to cover all those accessories. Nina over at WheelingIt just did a great round up of her experience extended warranties.

Oh I missed that post of hers. I didn’t know you could get a warranty on used RVs. Thanks!

Seriously? Housing is cost. Always has been, always will be. A 15 year mortgage on a houze is ok, even though after repairs, upgrades, taxes and selling costs, not to mention the last 6 years of actusl home devaluation, you never really “gain” on a house.

We financed a new 40′ 5er with an awesome bunkhouse for the boys. Nothing used could even touch it pricewise. In addition, as a debt/cost it is well within our earning capabilities. In your situation, quality used units that have seen the majority of the early devaluation will be more readily available.

Personally, I think Ramsey gives horrible advice in relation to loans. Credit cards, sure, but I think he gave you a horrible opinion. You are not buying the trailer to make money off of ( not an investment), but to use. Where careful thought needs to be made ii what is an acceptable.cost in relation to earnings, budget and future savings/investments.

But I don’t have a radio show….

I dunno Phillip, I’ve been going back and forth about financing but in the end Dave’s advice was a reality check for me. There is just such a freedom in knowing that we aren’t beholden to a certain bill every month, especially one tied to our housing.

As for the drop in housing prices over the last few years, Dave’s advice is to see the bigger picture and not look for quick returns right now. His thinking is exactly like the woman who handles our retirement planning, so we trust it and run with it.

But I’m still jealous about your 40′ 5er! I’ve told Jim that we need trailer with a bunkhouse so we could convert that to an office. Nice!

Renee,

Regarding housing “payments”, campsite fees, house or apartment rent or property taxes on a paid for home, it is extremely rare to not have a monthly “cost” for housing. We chose to purchase a new vs used RV in 2010 because the price differential between the steep discounts the dealership offered and what people needed to pay off the note on their 3-4 yr old RV averaged $8k. YMMV.

Regardless, our hard housing cost is $300/mo. Ramsey would frown on this because it doesn’t fit into his narrow view of debt, but in reality we lend 1/4 what we formerly spent on housing allowing us to utilize our monies in far more useful ways than enriching the bank with front loaded mortgage interest. Granted not everyone can live in a smaller home as we full time rv’ers do, but to us capable (and might I add-superior) people, the lower cost and flexibility of a “roiling home” far outweighs the “cost” of home “ownership” (try not paying your property taxes).

I think the empiracal answer from Dave, is short sighted and due to a myopic view of debt. The questions should be “What do we need?”, “What do we want our monthly housing cost to be in relation to income and savings?” and “If we need to borrow funds to purchase, will our income stream support the monthly payments til satisfied?”.

For example, I could use a newer truck. There is a 2011 Ford F350 nearby for $45k. Perfectly fits the bill for an upgrade. Need easily met. Monthly cost is within budget. I am still uncertain on business income. Super wild swings this year leave me reticent to take the debt risk or commit to the additional expense. It should be noted I expect in the next two years major component failures with my existing truck which will drive up the yearly cost to match the cost of a financed truck. Maybe ill

Hey ya got cut off there Phillip.

I think that Dave has a narrow POV when it comes to debt but it’s only because he is looking at the greater picture for his/our financial future, which is building enough wealth to live comfortably into old age and if you have kids, setting up their comfortable futures too.

So, if you didn’t have that $300 payment, what could you do with that amount over the course of the next 20 years and how much wealth could it add to your overall financial picture?

Just playing devil’s advocate. I totally hear what you’re saying, it’s a good argument.

Same could be said of ‘What if you didn’t spend $400/mo in fuel to move your RV’ or ‘What if you didn’t spend $300/mo for that monthly RV spot?’. Sure, if you don’t spend money and instead save it.. you’re going to build wealth with it.

I’m in general not a fan of debt. However when it comes to housing, it’s an area that greatly impacts your mental well being and I think is merits different thinking to find the right balance for yourself.

If you have the means to pay the bill, I personally consider taking on debt to buy your abode (wheels or not) a worthwhile consideration if it is very consciously approached. And absolutely keep in mind that all odds are that the RV will go down in value (so far, all of ours have gone up… but we’re some sort of anomaly).

A $300/mo payment on an abode that very well meets the needs of Phil’s family (disclosure: we visited with them rather recently and have more insight into their unique situation) – is actually quite tiny in comparison to what most folks are paying for rent on a property that they have no investment in, or mortgage on a property that may or may not increase in value.

I would argue that if Phil didn’t have the $300/mo payment on the 5th Wheel, he’d have either a higher payment on a house or a higher psychiatric bill to keep his family mentally sane due to their lessoned living conditions. 😀

I agree with buying a used trailer. Sam and I bought an older 29′ Alpenlite (2000). Other than it’s interior being dated it was like new in condition. When we sold it a year and a half after we bought it, we got back what we paid. Buy a quality brand and look it over good before you purchase and I don’t think you can go wrong. There are many trailers out there than haven’t had many miles put on them. Scour the internet and look all over the country. When you buy new you still have problems. Our first trailer was new and it took at least a year to work out all the bugs. We would never buy new again. In fact, we did just buy another trailer – a slide in truck camper that we got a great deal on. It’s in excellent shape despite being about 10 years old.

I like that you got back what you paid for it Kim!

Jim and I are now thinking that we’ll go 2 years old, by the same manufacturer. The Arctic Fox line holds its value so well, we’ll stick with it.

I can’t wait to see pics of your new camper!

How cool that you got on his show! We listen every once in a while…mainly the podcast while we are driving. Like the previous commenter said… speedy saving!

Thanks Teri! We can use all the cheerleading we can get for our savings plan!

+10 on Dave Ramsey!

-10 on Fox News drivel, this country is where we are at because of journalistic malpractice from the mainstream 3 letter networks who failed to vet a candidate in 2008. Hillary would have been 10x the worker-bee.

Hey Dave, right on!

I am sure the opinions from MSNBC and CNN are unbiased…. not… All news sources should be considered biased. our job is to listen and decide what “we” believe to be true.

We are two years from selling everything and hitting the road for at least a year. We will be working part time and will be financing whatever rig we buy. For us, the lifestyle is worth it.

Hey Rick, we all have to do what works for our individual situations. Good luck getting ready to full-time! Oh by the way, Dave’s radio show is on satellite radio, not sure how biased that might be. But I do consider him to be a rebel when it comes to financial advice. After all, it’s in the networks’ advertisers best interests to keep us consuming and in debt, which Dave is completely against.

Hey Rene and Jim! Great topic, and love that you were able to put aside your disdain for Dave’s association with Fox News to take some advice from him. I wish more people were willing to do that. I think everyone has something to offer, and too many of us are too quick to throw out the baby with the bath water because we don’t like one aspect of someone or something. Personally I don’t go for his religious emphasis, but I can easily ignore that and still appreciate his excellent financial advice.

Anyway – to the subject of upgrading the 5th wheel. What about an older one? As you know, I live in a 29′ Alpenlite. It’s a 1994 and a nice rig. It was rough when I bought it, but I’ve put in some elbow grease and a minimal amount of money to improve it. It really doesn’t take much if you start with a well-built rig to begin with. Most of the work was cosmetic, and I’ve saved tens of thousands of dollars over buying a new one. I paid $4,400 for it, probably spent another $1,500 for vinyl flooring, a new heater, some dry rot repair, Eternabond for the roof, etc. Luckily I have the time and knowledge/ability to do this kind of thing, which could be a limiting factor for others. But even a rig in excellent condition a few years old will save thousands. Anyway, thought I’d throw that out there. Hope you two are doing well!

Hey Gary, it’s nice to hear from you! I’m with you on Dave’s religious bent…I just tune it out. He has so much more to offer than the bible passages he likes to quote, so I blow it off (while gritting my teeth!).

As for an older rig. I’m not completely opposed to one that’s a couple of years old. I swore after buying new that we wouldn’t do it again, because I know how much they drop in value. But honestly, we’re chicken to go the used route. It’s been so nice having a new one without any issues. The thought of buying a used trailer and being at the mercy of how someone else treated it when we’re out there in the sticks or on the road, well it makes us nervous to think of dealing with those hassles.

Jim’s a handy guy, for sure, so we’re not ruling out a good used one, especially if it means we’ll get to our upgrade a lot faster. I just get antsy, I hate having to wait. But that’s all part of the debt-free lifestyle, isn’t it? Live like no one else now, so that some day you will live like no one else.

Ohhhhh yeah.

I hear ya on the fear of being dependent on how someone else treated the rig, especially when you’re going to be on the road so much with it. Mine never moves, so it’s not much of an issue for me. But as far as what to worry about when on the road, with a 5th wheel you have the wheels, suspension, brakes, tires and…..well I guess the hitch, but that’s about it. Of course you don’t want to be in the middle of nowhere in 30-degree temperatures when your heater breaks, or in AZ in the summer when your A/C gives out, or in the middle of a deluge anywhere when you discover all your roof seams leak. So I get that. Personally, I’m comfortable doing a little “preventative maintenance” to minimize the risk of those things happening, but there aren’t any guarantees, regardless.

As far as waiting…..yes, there are huge advantages to a little patience, even if it is hard sometimes. 🙂

Good advice from Dave, but what about a slightly larger used RV instead? Something you can pay cash for without having to borrow so much to buy new? There sure seem to be lots of good deals out there on used RV these days. Of course, that cuts both ways– your current RV’s resale value will be limited too.

I went thru a spell where I was wanting to trade up from my 24′ Winnebago View, but a few recent simple mods have made my View alot more comfy, so now I’m happy to keep it longer (and may ultimately choose to go even smaller if I decide to buy a “home base” park model rather than carry all my worldly possessions in the RV).

I still own a sticks-n-bricks house and have watched its value continue to fall the last few years and still not hit bottom yet. Recently, I’ve been thinking of it more like a “depreciating asset” (just like a vehicle), so am now thinking it wise to pay down the mortgage faster rather than my previous mindset of just paying the minimum monthly payment and letting excess cash work elsewhere in other investments. The savings in mortgage interest fees might now just be more than what I can earn via income tax breaks and other investments! Weird world we now live in!

Hey Lynne, thanks for reading. See my response to Gary, above.

Good to hear you’re paying down that mortgage. If you haven’t already read Dave’s book you should check it out, he’s got lots of sound advice for paying it off early.

As a regular listener of this show, I knew it was you immediately even though I really didn’t listen to the name of the caller. I listened to the disappointment in your voice as he said you shouldn’t take out a loan. 🙂 I hope you can save up quick for that new trailer. Are you thinking of a new one or a used one? I totally understand wanting to move up in size……I’ve been there! Speedy saving!

Hee hee! Yeah, I was disappointed when he said that mostly because right then I knew, Jim WON the argument! Grrrr!!!!

See my response to Gary about buying new versus used.

So glad you got to hear the show. I was scared to death!