Back when we ran our little business enterprise in Eureka, California, the heart of our operation ran on blood, sweat and credit.

As CEO I was proficient at filling out loan applications for everything from American Distress cards to low-doc SBA loans to home equity lines. We did whatever we could to leverage our accounts receivables, believing at the time it was a smart way to run a business.

Thanks to Dave Ramsey, now we know better, but as they say, hindsight is 20/20. Recently when we returned to Jerry’s Acres it became clear to me how enslaved to our lenders we were back then.

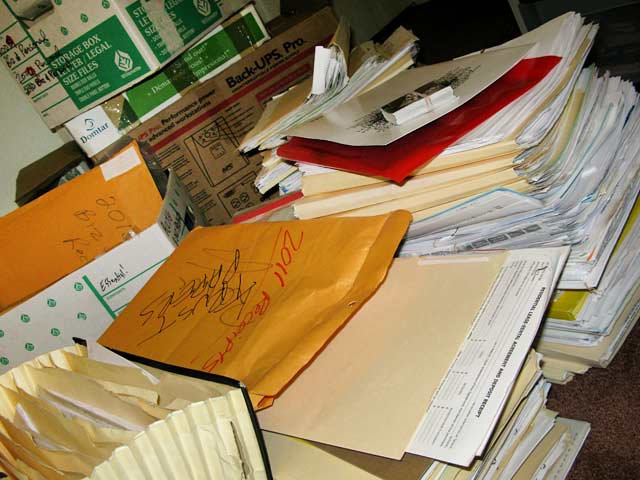

I was tossing out records that exceeded the seven-year statute of limitations on IRS audits. With each discarded pile I became more astonished at how much mental energy and physical space it took to maintain credit relationships. Each year of our business took up an entire banker’s box full of receipts, and that was after downsizing and selling the business.

Today, as debt-free believers, it takes one extra-large Ziploc bag to hold vital records from our business and personal lives. Sure, much of what we keep now is electronic, but even that is minimal.

The simple fact is that when you’ve handed over your life, your income and your free-time to debt slavery, it takes an incredible amount of mental and physical resources to keep it under control.

It’s not easy to delay gratification and live without debt, but the rewards are so worth it.

Recommended Reading: